Let's say you have 100 shares of stock worth $100,000 today (so each share is $1,000) and in one year it goes up 10% and is reinvested. Then in one year your 100 shares will become 110 shares.

But in one year how much real value do you have in stocks? 110 shares x $900/share = $99,000. So your $100,000 in stocks became $99,000 even though your stock portfolio increased by 10%.

This is an illustration of why you need to consider "purchasing power" of your dollars. Not just the nominal value of your account statement.

I used "inflation" in the example, but you could easily replace it with "devaluation" or "diluted value" due to the Federal Reserve's inflation of the money supply by adding trillions of dollars. 1 trillion is 1,000 billion.

And this doesn't even consider the artificial nature of the stocks rising due to share buy back plans and other transient stimulants.

The point I'm trying to convey is to find a way to protect your purchasing power. I have no financial credentials, and you need advice you can trust, so it would be worth your time to ask about this with your trusted financial advisor.

|

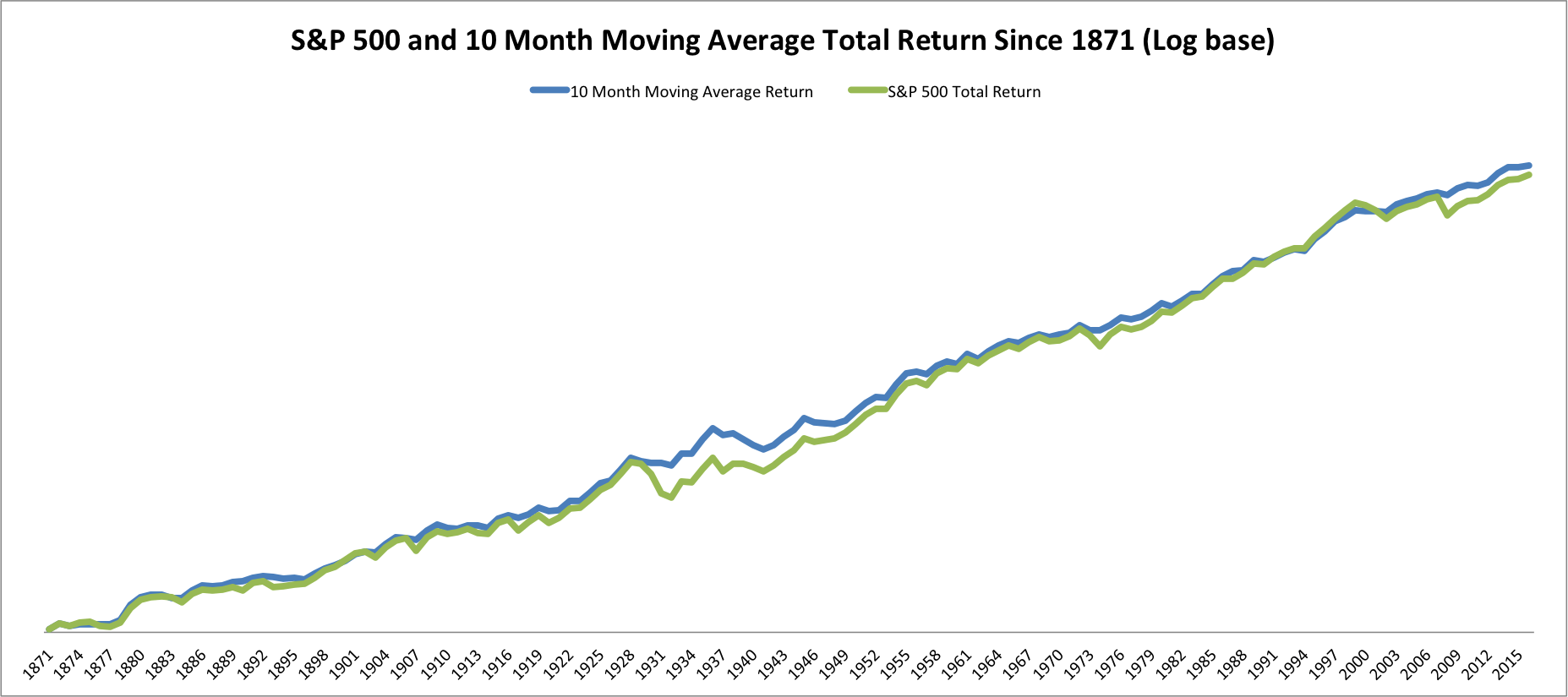

| https://seekingalpha.com/article/4336860-long-term-stock-market-timing-since-1871 |

|

| Falling Purchasing Power |

No comments:

Post a Comment