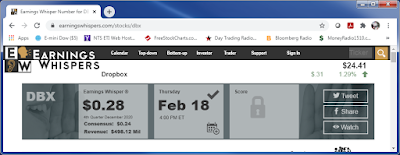

The top image is from earningswhisper.com showing DBX expectation was $.24 EPS with an actual of $.28 EPS. .04/.24=17% beat. $.04 seems mild but it should allow our Bullish setup to continue, unless management says something bearish.

The top chart in the middle is a 1 minute chart showing the reaction to the ER release. The bottom chart is a wider view of the whole setup.

At about 15:45, before the ER release, I decided to sell the Apr 25 Call for $2.47 and buy a Feb 26th 25 Call for $1.26. This cut my risk in half, and if we got a positive report (which we now know we did), then the much higher Gamma will give us more profit if the move is big enough such that the higher Gamma will overcome the higher Theta.

Doing this resulted in a small loss on the April option:

2.47-2.96=-$49.

Keeping the target the same at $29.

Now that we know the ER turned out well, I may buy a longer dated option when we sell the Feb 26th option, if we haven't hit the target yet and the risk/reward makes sense.

No comments:

Post a Comment